Understanding PMVVY Interest Rate: A Comprehensive Guide

The PMVVY interest rate is a crucial element for seniors looking to secure their financial future through a reliable investment scheme. This article delves into the intricacies of the Pradhan Mantri Vaya Vandana Yojana (PMVVY), focusing on its interest rates, benefits, and how it can serve as a financial cushion for the elderly. By understanding PMVVY interest rates, seniors can make informed decisions that greatly impact their retirement planning.

In this guide, we will explore the details of PMVVY, its features, and how the interest rate plays a significant role in maximizing returns. Whether you are a retiree or planning for retirement, understanding these aspects will help you leverage PMVVY to enhance your financial security.

Join us as we break down the key components of PMVVY interest rates, their implications, and how they compare to other investment options available in the market today. With a focus on providing valuable insights, you will gain knowledge that empowers your financial decisions.

- Kathryn Morris The Journey Of A Talented Actress

- Kevin Hart Height The Truth Behind The Comedians Stature

Table of Contents

- What is PMVVY?

- Understanding PMVVY Interest Rate

- Features of PMVVY

- Benefits of PMVVY

- How to Apply for PMVVY

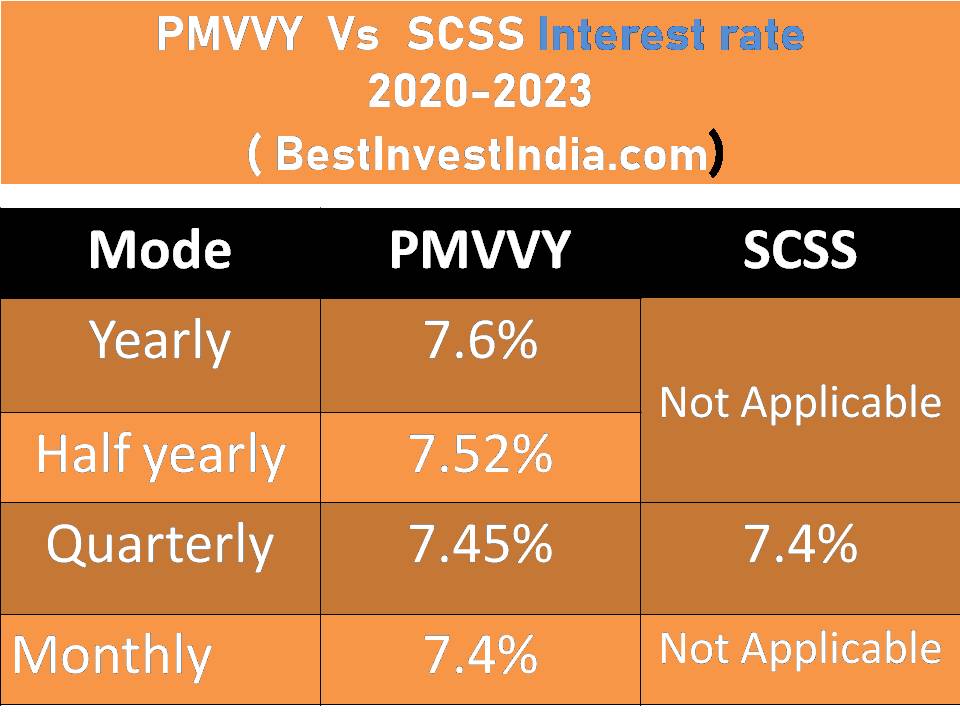

- PMVVY vs Other Investments

- PMVVY Interest Rate Fluctuations

- Conclusion

What is PMVVY?

The Pradhan Mantri Vaya Vandana Yojana (PMVVY) is a pension scheme initiated by the Government of India specifically designed for senior citizens aged 60 years and above. Launched in 2017, this scheme aims to provide a steady income stream during retirement to enhance the quality of life for elderly individuals.

PMVVY offers a unique combination of benefits, including a guaranteed return, flexibility in payouts, and a government-backed safety net. With an attractive interest rate, it has become a popular choice among retirees seeking financial stability.

Under this scheme, seniors can invest a lump sum amount and receive monthly pensions for a specified period, ensuring their financial needs are met without the stress of market volatility.

- Maluma Net Worth A Comprehensive Look At The Wealth Of The Colombian Superstar

- Taurus Compatibility Discovering The Best Matches For Taurus

Understanding PMVVY Interest Rate

The PMVVY interest rate is fixed at the time of investment and remains constant throughout the tenure of the policy. Currently, the interest rate is set at 7.4% per annum, making it an attractive option for fixed-income investors.

This interest is paid out monthly, providing a regular source of income for retirees. The interest rate is reviewed periodically by the government, which means it may change in the future based on market conditions and economic factors.

How is the PMVVY Interest Rate Determined?

The determination of the PMVVY interest rate is based on several factors:

- Market interest rates

- Inflation rates

- Economic conditions

- Government policies and regulations

Impact of Interest Rate on Returns

The interest rate directly impacts the returns received by the policyholder. A higher interest rate translates to higher monthly payouts, which is particularly beneficial for retirees who depend on this income for their daily expenses.

Features of PMVVY

The PMVVY scheme comes with several features that make it an attractive option for senior citizens:

- Guaranteed Returns: PMVVY offers fixed returns, ensuring financial security.

- Flexible Payout Options: Policyholders can choose between monthly, quarterly, half-yearly, or annual payouts.

- Loan Facility: Policyholders can avail of loans against their PMVVY policy after a specified period.

- Tax Benefits: The investment made is eligible for tax deductions under Section 80C of the Income Tax Act.

Benefits of PMVVY

Investing in PMVVY offers numerous benefits, including:

- Steady Income: It ensures a regular income stream for retirees.

- Government Backing: Being a government scheme, it is considered safe and reliable.

- Inflation Protection: The fixed interest rate helps protect against inflation to some extent.

- Ease of Access: The application process is simple and can be done online or offline.

How to Apply for PMVVY

Applying for the PMVVY scheme is a straightforward process. Here are the steps to follow:

- Visit the official website of the Life Insurance Corporation of India (LIC) or authorized banks.

- Fill out the application form and provide necessary documents.

- Choose the investment amount and payout frequency.

- Submit the form along with the premium payment.

PMVVY vs Other Investments

When comparing PMVVY to other investment options such as fixed deposits or mutual funds, several factors come into play:

- Risk Level: PMVVY is a low-risk investment, while mutual funds carry market risks.

- Returns: PMVVY offers guaranteed returns, whereas fixed deposits have varying rates.

- Payout Flexibility: PMVVY offers more payout options compared to traditional investment schemes.

PMVVY Interest Rate Fluctuations

Interest rates for PMVVY are subject to periodic reviews by the government. Factors affecting these fluctuations include:

- Changes in economic policies

- Shifts in the overall interest rate environment

- Inflation trends

It is essential for potential investors to stay informed about these fluctuations to make timely investment decisions.

Conclusion

In conclusion, the PMVVY interest rate plays a pivotal role in providing financial security to senior citizens. With an attractive fixed interest rate of 7.4%, PMVVY stands out as a reliable investment option in today’s market. Its features and benefits make it an ideal choice for retirees looking for a steady income stream.

If you are considering investing in PMVVY, take the time to evaluate your financial goals, and ensure that this scheme aligns with your retirement plans. Feel free to leave a comment below, share this article with others who might benefit, and explore more of our content related to financial planning and investment strategies.

We hope you found this guide on PMVVY interest rates informative and useful. Stay tuned for more insights and updates on financial topics that matter to you!

- Park Eun Bin The Rising Star Of South Korean Entertainment

- Exploring The Life And Adventures Of Alex Honnold The Climber Who Redefined Free Soloing

PMVVY Vs Senior Citizen Saving Scheme Which is better investment for

PMVVY scheme gets extended at a reduced interest rate Value Research

PMVVY scheme Interest rate, calculation, details; couples plan