PMEGP Loan Apply Online: A Comprehensive Guide

The PMEGP loan is an essential financial tool for aspiring entrepreneurs looking to start or expand their businesses in India. This scheme, initiated by the Ministry of Micro, Small and Medium Enterprises (MSME), provides financial assistance to small enterprises. In this article, we will explore everything you need to know about applying for a PMEGP loan online, including the eligibility criteria, application process, and benefits of the scheme.

The PMEGP (Prime Minister's Employment Generation Programme) aims to promote self-employment and generate employment opportunities in rural and urban areas. Through this loan, entrepreneurs can secure funding for various business ventures, making it a popular choice among small business owners. As we delve deeper, you will gain a better understanding of how to navigate the application process effectively.

By the end of this article, you will be equipped with valuable insights into PMEGP loan applications, allowing you to take the necessary steps toward realizing your business dreams. Whether you're a seasoned entrepreneur or a first-time applicant, this guide will provide you with the tools and information you need to succeed.

- Liam Payne A Comprehensive Look At His Life And Career

- Jesse L Martins Wife A Deep Dive Into His Personal Life

Table of Contents

- What is PMEGP?

- Eligibility Criteria for PMEGP Loan

- Application Process for PMEGP Loan

- Documents Required for PMEGP Loan

- Benefits of PMEGP Loan

- Loan Amount and Subsidy under PMEGP

- Repayment Terms for PMEGP Loan

- Common Queries about PMEGP Loans

What is PMEGP?

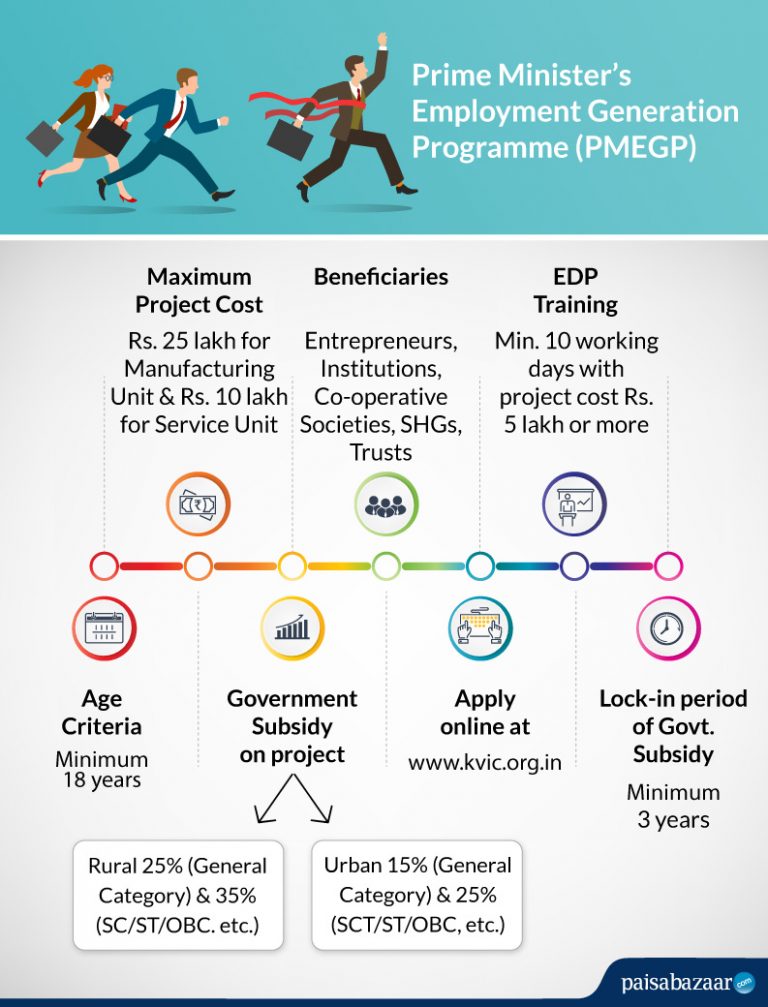

The Prime Minister's Employment Generation Programme (PMEGP) is a significant initiative aimed at promoting self-employment among the youth in India. Launched in 2008, it serves as a subsidy-linked credit scheme to encourage the establishment of small-scale enterprises. The program is implemented by the Khadi and Village Industries Commission (KVIC) and focuses on providing financial support to both new and existing businesses.

Under PMEGP, eligible candidates can receive loans to set up manufacturing and service enterprises, which play a crucial role in generating employment opportunities. The scheme is designed to assist individuals, especially those from rural areas, in becoming self-reliant and contributing to the economy.

Eligibility Criteria for PMEGP Loan

To apply for a PMEGP loan, applicants must meet specific eligibility criteria, which include:

- How Talk Is Riley Green The Rising Star Of Country Music

- Slash Net Worth Exploring The Wealth Of The Legendary Guitarist

- Age: The applicant should be at least 18 years old.

- Educational Qualification: The minimum educational qualification required is 8th standard. However, technical skills or experience in the relevant field can be advantageous.

- Business Type: The loan is available for both manufacturing and service-oriented businesses.

- Geographical Location: The applicant must be a resident of the country.

- Previous Loans: Individuals who have availed of a PMEGP loan previously are eligible to apply again, subject to certain conditions.

Application Process for PMEGP Loan

The application process for a PMEGP loan is straightforward. Follow these steps to apply online:

- Visit the official PMEGP website or the KVIC portal.

- Fill out the online application form with all required details.

- Upload the necessary documents as specified.

- Submit the application form.

- Track your application status through the portal.

Step-by-Step Guide to Applying Online

Here is a more detailed breakdown of the application steps:

- **Create an Account:** If you are a first-time user, create an account on the PMEGP portal.

- **Complete the Application Form:** Fill in your personal details, business details, and project proposal.

- **Attach Documents:** Ensure all required documents are uploaded correctly.

- **Review and Submit:** Review your application for accuracy before submitting it.

- **Receive Acknowledgment:** After submission, you will receive an acknowledgment receipt with a reference number.

Documents Required for PMEGP Loan

When applying for a PMEGP loan, you will need to provide certain documents to support your application. These typically include:

- Identity Proof (Aadhaar Card, Voter ID, etc.)

- Address Proof (Utility Bills, Rental Agreement, etc.)

- Educational Certificates

- Business Project Report

- Bank Account Details

- Passport-sized Photographs

Benefits of PMEGP Loan

The PMEGP loan offers several advantages to aspiring entrepreneurs, including:

- **Subsidy Support:** A significant portion of the loan amount is provided as a subsidy.

- **Low-Interest Rates:** The interest rates on PMEGP loans are relatively low compared to conventional loans.

- **Financial Assistance for Various Sectors:** The scheme supports both manufacturing and service sectors, providing flexibility in business choice.

- **Boosts Employment Generation:** By promoting entrepreneurship, PMEGP contributes to job creation in the country.

Loan Amount and Subsidy under PMEGP

The PMEGP loan provides financial assistance based on the category of the applicant:

- For general category applicants, the maximum loan amount is INR 25 lakh for manufacturing and INR 10 lakh for service industries.

- For special categories (SC/ST, women, minorities, and physically challenged), the maximum loan amount is INR 35 lakh for manufacturing and INR 15 lakh for service industries.

The government provides a subsidy of 15% to 35% on the total project cost, depending on the location and category of the applicant.

Repayment Terms for PMEGP Loan

The repayment terms for PMEGP loans are designed to be manageable for borrowers:

- The repayment period typically ranges from 3 to 7 years.

- EMI (Equated Monthly Installment) payments begin after the moratorium period, which is usually 6 months from the date of loan disbursement.

Common Queries about PMEGP Loans

As you prepare to apply for a PMEGP loan, you may have some common questions:

- **Can I apply for a PMEGP loan online?** Yes, the application process is available online through the official portal.

- **What is the maximum subsidy amount I can receive?** The subsidy amount is up to 35% of the project cost, varying by category and location.

- **How long does the loan approval process take?** The approval process can take anywhere from a few weeks to a couple of months, depending on the completeness of your application and documentation.

Conclusion

In conclusion, the PMEGP loan is an excellent opportunity for aspiring entrepreneurs looking to start or expand their businesses. By understanding the eligibility criteria, application process, and benefits, you can make informed decisions about your financial future. We encourage you to take the next step and apply for a PMEGP loan online, enabling you to unlock your entrepreneurial potential.

If you found this article helpful, please leave a comment below, share it with others, or explore more articles on our site for additional insights and information.

Penutup

Thank you for reading our comprehensive guide on PMEGP loans. We hope you found the information valuable and are inspired to take action. We invite you to return for more articles and resources that can help you on your journey to success!

- Bad Boy For Life The Journey Of Piddy Withrums

- Homer James Jigme Gere The Life And Legacy Of An Influential Figure

PMEGP Loan Apply Online 2023 रोजगार शुरू करने के लिए 25 लाख तक का लोन

PMEGP Loan Apply Scheme, Online Application Process, Subsidy, Guidelines

how to apply pmegp loan online pmegp apply online 2022 pmegp loan