Understanding Vaya Vandana Yojana Interest Rate: A Comprehensive Guide

In recent years, the Vaya Vandana Yojana has emerged as a popular scheme for senior citizens in India, providing them with a reliable source of income through a government-backed investment. One of the key features that attract investors to this scheme is the interest rate it offers. This article will delve deep into the Vaya Vandana Yojana interest rate, its benefits, and how it stands out in the current financial landscape. We will also explore its eligibility criteria, application process, and compare it with other investment options available for senior citizens.

As individuals approach retirement, securing a stable income becomes a top priority. The Vaya Vandana Yojana provides a safety net for the elderly, ensuring they do not face financial instability. With the government backing this scheme, it is regarded as a low-risk investment, appealing to many. In the following sections, we will cover every aspect of the Vaya Vandana Yojana, particularly focusing on its interest rate and how it serves the needs of senior citizens.

The importance of understanding the Vaya Vandana Yojana interest rate cannot be overstated. It directly influences the returns on the investment made by the subscribers. Whether you are a prospective investor or someone looking for options to secure your retirement, this article aims to equip you with all the necessary information regarding the Vaya Vandana Yojana and its interest rate.

- Michael Landons Last Performance A Tribute To A Legendary Actor

- Kathy Bates The Queen Of American Horror Story

Table of Contents

- 1. Vaya Vandana Yojana Overview

- 2. Interest Rate Details

- 3. Eligibility Criteria

- 4. Application Process

- 5. Benefits of the Scheme

- 6. Comparison with Other Investment Options

- 7. Common Queries about Vaya Vandana Yojana

- 8. Conclusion

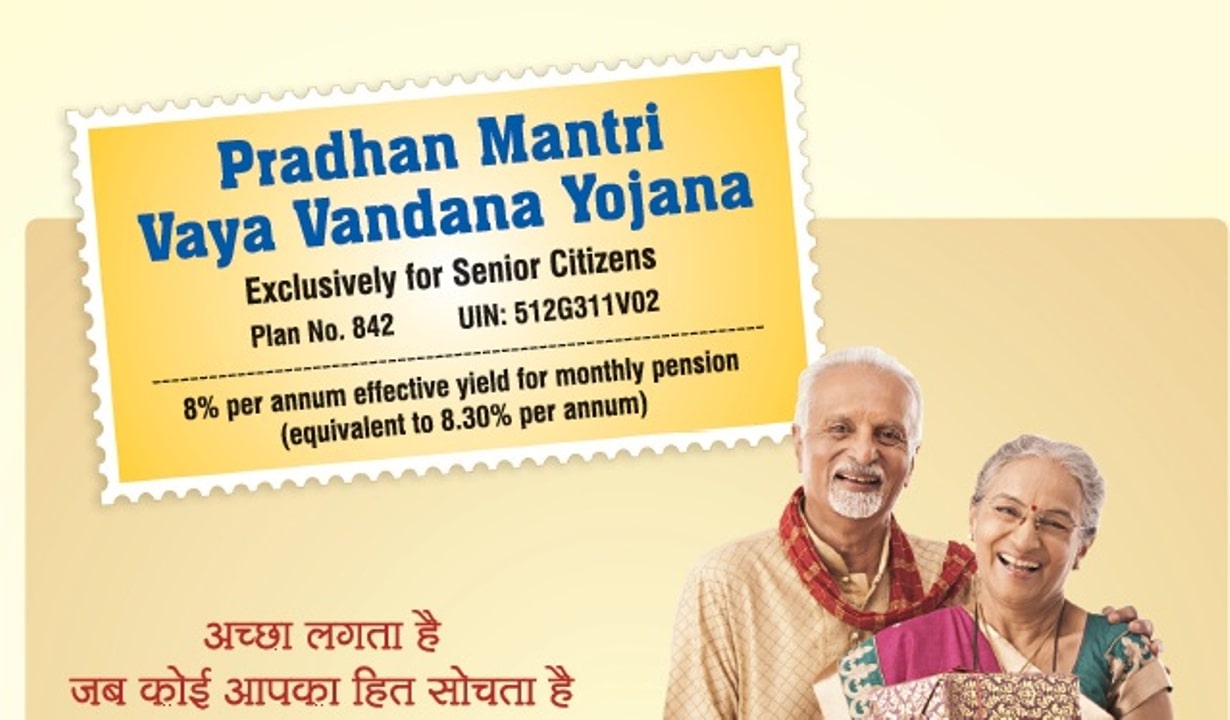

1. Vaya Vandana Yojana Overview

The Vaya Vandana Yojana is a government-supported pension scheme launched by the Ministry of Finance, India. It was specifically designed for senior citizens aged 60 years and above. The scheme aims to provide a steady income stream through monthly pensions, ensuring financial security during retirement.

Key features of the Vaya Vandana Yojana include:

- Eligibility for individuals aged 60 years and above.

- The scheme offers a fixed interest rate, which is announced by the government annually.

- Investors can contribute a lump sum amount, with a maximum limit set by the government.

- Monthly pension payments are made for a fixed duration, providing a reliable income source.

2. Interest Rate Details

The interest rate for the Vaya Vandana Yojana is one of its most attractive features. As of the latest update, the interest rate stands at 7.40% per annum, payable monthly. This rate is significantly higher compared to traditional savings accounts and fixed deposits, making it a compelling option for senior citizens looking for stability and returns on their investments.

- Nathan Fillion A Comprehensive Look At The Life And Career Of The Beloved Actor

- Anson Williams The Multifaceted Career Of A Beloved Actor And Director

How the interest is calculated:

- The interest is calculated on the total investment amount.

- Monthly pension payments are derived from the interest accrued, ensuring regular cash flow for investors.

- Investors can choose to receive their pension monthly, quarterly, half-yearly, or annually, based on their financial needs.

Current Interest Rate Trends

The interest rates for government schemes like Vaya Vandana Yojana are subject to change based on the economic climate and RBI policies. It is essential for potential investors to stay updated with any changes to make informed decisions.

3. Eligibility Criteria

To invest in the Vaya Vandana Yojana, applicants must meet certain eligibility requirements:

- Must be a resident of India.

- Must be at least 60 years of age at the time of investment.

- Individuals can invest jointly with their spouses, provided both are above the age of 60.

- The total investment amount should not exceed the prescribed limit set by the government.

4. Application Process

The application process for the Vaya Vandana Yojana is straightforward and can be done through various channels:

- Online Application: Visit the official LIC website and fill out the online application form.

- Offline Application: Download the application form from the website, fill it out, and submit it to the nearest LIC office.

- Required Documents: Applicants must provide identity proof, age proof, and other relevant documents as specified.

5. Benefits of the Scheme

Investing in the Vaya Vandana Yojana comes with a multitude of benefits:

- Guaranteed Returns: The interest rate is fixed and guaranteed, ensuring consistent returns.

- Assured Monthly Income: Investors receive a regular monthly pension, contributing to their financial stability.

- Government Backing: Being a government scheme, it is considered a low-risk investment.

- Tax Benefits: The scheme may offer certain tax benefits under Section 80C of the Income Tax Act.

6. Comparison with Other Investment Options

When considering retirement investment options, it’s essential to compare the Vaya Vandana Yojana with other alternatives:

| Investment Option | Interest Rate | Risk Level | Liquidity |

|---|---|---|---|

| Vaya Vandana Yojana | 7.40% | Low | Low |

| Fixed Deposits | 6.00% - 7.00% | Low | Medium |

| Public Provident Fund (PPF) | 7.10% | Low | Low |

| Senior Citizens Savings Scheme (SCSS) | 7.40% | Low | Medium |

7. Common Queries about Vaya Vandana Yojana

Investors often have questions about the Vaya Vandana Yojana. Here are some common queries:

- Can I withdraw my investment before maturity? No, the scheme has a lock-in period, and premature withdrawals are not allowed.

- What happens to the investment after the demise of the investor? The nominee will receive the principal amount invested.

- Is there a limit on the investment amount? Yes, the maximum investment limit is set by the government.

8. Conclusion

In conclusion, the Vaya Vandana Yojana interest rate makes it a lucrative option for senior citizens looking for a stable source of income post-retirement. With its government backing, fixed interest rate, and assured monthly pensions, the scheme stands out as a reliable investment choice. We encourage readers to evaluate their financial needs and consider the Vaya Vandana Yojana as part of their retirement planning strategy.

If you have any questions or experiences to share regarding the Vaya Vandana Yojana, feel free to leave a comment below. Don’t forget to share this article with others who might benefit from it, and explore more informative content on our site!

- Piddy Batmobile The Ultimate Guide To The Iconic Vehicle

- Piddy 90s A Nostalgic Journey Through The Iconic Era

LIC PMVVY Scheme From assured return to Rs 15 lakh payout, check top

Pradhan Mantri Vaya Vandana Yojana (PMVVY) ★ Excellent Pension Plan For

Pradhan Mantri Vaya Vandana Yojana 2022 Application Form, Interest Rate